Japan's Tax Exemption

Purchase combined general goods and consumable goods become available for tax-free shopping.

Japan's tax exemption program

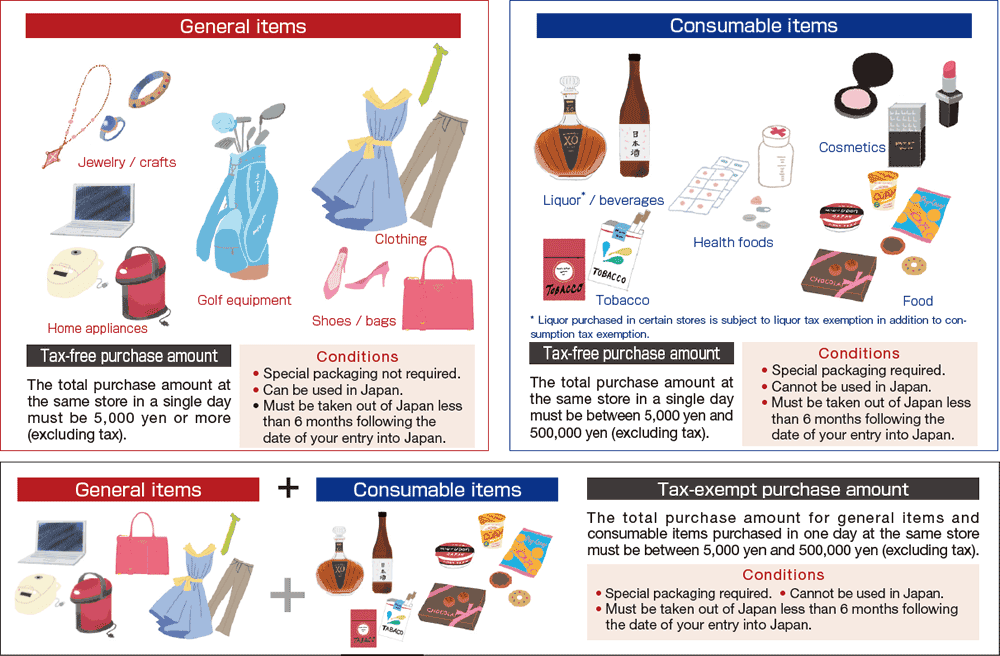

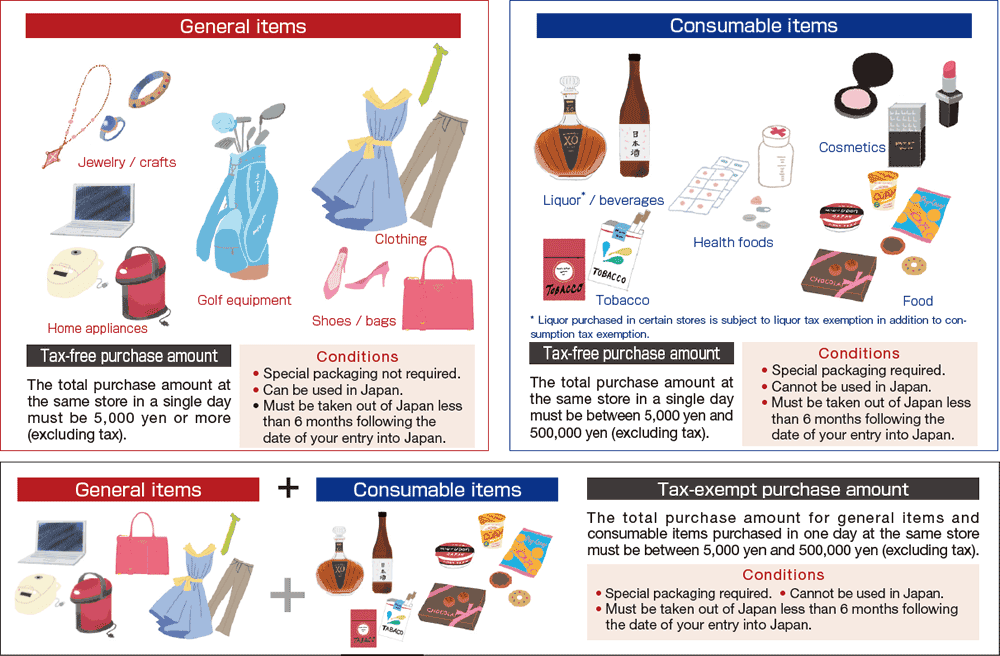

To make the most of shopping in Japan, you need to know about Japan's tax exemption program. Tax exemption in Japan basically applies to all items, from general items such as home appliances, accessories, and shoes, to consumable items such as alcohol, food, cosmetics, tobacco, and medicines. Tax is exempt only under certain conditions. Learn more below.

-

POINT

1The 10% consumption tax may be exempted.

Certain items are subject to the reduced tax rate of 8%. Visit the following website for more information about the reduced tax rate.

https://www.mof.go.jp/english/tax_policy/tax_system/consumption/index.html#a03

-

POINT

2When you purchase merchandise, you can pay the tax-exempt price.

The tax refund procedure must be carried out while at an airport or similar location. To carry out the procedure, you must show your actual passport, not a copy of the visa page. Tourists traveling by cruise ship need to show their cruise ship tourist permit.

* For those on the Trusted Traveler Program (TTP), be sure to bring your passport along with your Registered User Card. -

POINT

3Purchases that total 5,000 yen or more qualify for a tax refund.

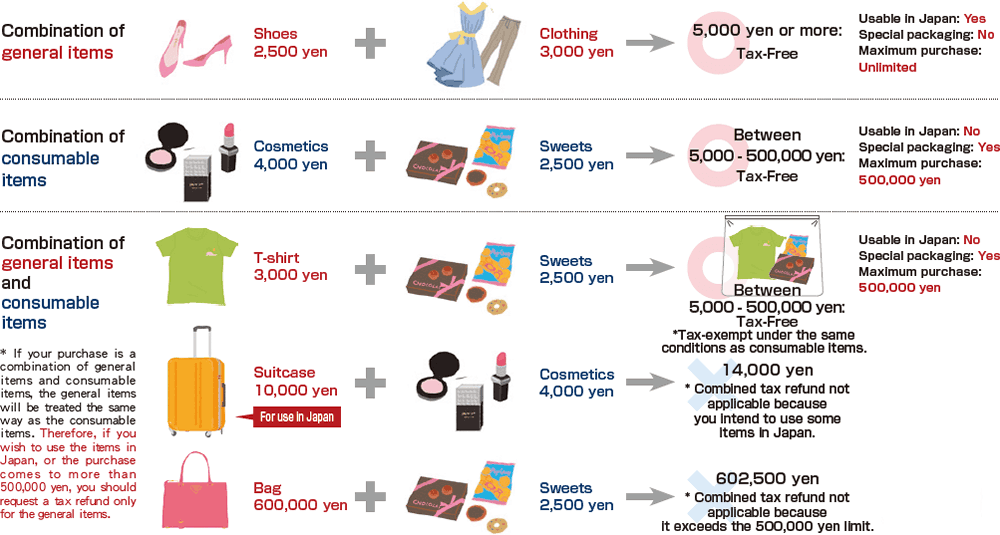

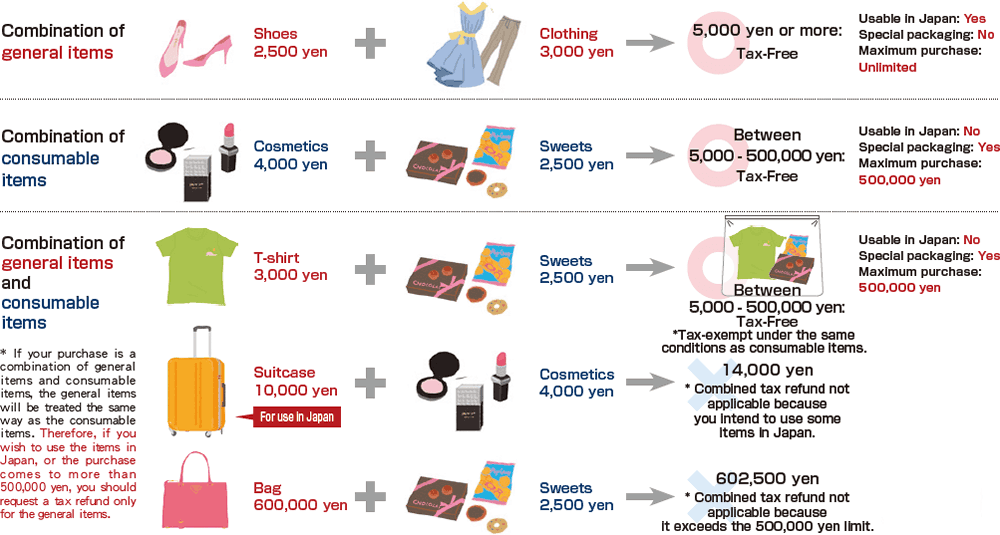

The terms and conditions of tax refunds depend on the type of product. Refer to the diagram below for details.

-

POINT

4The program only applies to foreign visitors in Japan temporarily!

This program is applicable to foreign visitors staying in Japan for less than six months only.

* Non-residing Japanese nationals may be eligible to apply for tax exemption.

* Some stores may not let you combine general and consumable items for a tax refund.Check with the store whether or not you can receive a refund for combined purchases.

Payments for items that are clearly for consumption within the country such as meals at restaurants are not eligible for tax exemption. Purchases made for business or sales purposes are also not eligible for tax exemption.

Is this tax exempt or not?

Let's check